Cost allocation in accounting is a critical practice that helps organizations assign costs to departments, products, or services to better understand profitability, resource use, and efficiency.

In this article, we’ll explore a standard cost allocation definition, cost allocation methods, and allocations in accounting practices with examples drawn from industries like financial services, telecom, government, and manufacturing. By seeing how cost allocation works in these enterprise environments, you’ll better understand its practical application and significance across different sectors.

We’ll also define key terms related to cost allocation in accounting, drill down into cost allocation definition, and explore the various methods and techniques that organizations can use to effectively manage their costs. Drawing on insights from cost allocation expert Sander den Hartog, CEO of CostPerform, we will break down the process and its challenges in a clear and structured manner.

By the end of this guide, you’ll have a deep understanding of the following key areas:

- What cost allocation is and why it’s important

- Definitions of allocated costs and their role in accounting

- Methods used for cost allocation

- The challenges and solutions involved in effective cost allocation

What is Cost Allocation?

Cost allocation is the process of distributing costs from a central point (such as a shared service center or a general overhead account) to specific cost objects, including departments, products, or services. These costs can be direct or indirect, and the goal is to ensure that each cost object is bearing its fair share of expenses. This process is essential for financial reporting, strategic decision-making, and regulatory compliance.

Moreover it is essential to diminish lots of discussions about “fair share” within a organization.

To define cost allocation in simpler terms: it is the process of identifying and assigning costs based on the resources used or the benefit received. For example, if a company’s IT department supports several departments, the cost of IT services must be allocated to those departments based on their actual usage.

This allocation ensures that each department understands its true cost structure and can make better decisions about resource allocation and budgeting. The fact that each department is being charged based upon usage makes them more cost aware.

Why is Cost Allocation Important?

Cost allocation is vital because it enables businesses to:

- Determine Profitability: By accurately allocating costs to the right departments or products, companies can better understand which parts of the business are profitable and which are not.

- Support Decision-Making: Management can use cost allocation to make informed decisions about resource allocation, pricing strategies, and investment opportunities.

- Ensure Financial Precision: Allocating costs accurately ensures that departments or products consuming more resources are assigned their proper share, which improves forecasting, budgeting, and resource allocation.

- Meet Regulatory Requirements: In certain industries, cost allocation is required by law or regulation to ensure that pricing is fair, transparent, and compliant.

- Improve cost awareness: By making the internal cost allocation consumption based, departments will manage their consumption more tightly.

Allocated Cost Definition

Allocated costs are usually expenses that have been divided among different cost objects, such as departments or products. These costs can be either direct (such as materials used in production) or indirect (such as administrative overhead). Furthermore these costs can be fixed (the cost of a management team) or variable (the number of Office 365 licenses). Allocating costs allows businesses to attribute shared expenses across different areas, providing a clearer picture of overall financial performance.

For example, if a company’s marketing department runs a campaign for multiple products, the cost of that campaign must be allocated across the various products based on metrics like sales volume or product relevance.

“The process of cost allocation must always maintain a cause-and-effect relationship: the entity that causes the cost should also bear the responsibility for it. This ensures resources are allocated based on actual consumption, not arbitrary decisions”

– Sander den Hartog, CEO CostPerform

What Are Allocated Costs?

Allocated costs are expenses that cannot be directly traced to a single product, department, or service but must be shared across multiple areas. Examples include utilities, rent, IT support, and general administrative costs. These costs are spread based on factors such as headcount, square footage, or machine hours.

The primary goal of allocated costs is to ensure that no department or product unfairly absorbs costs that should be shared across the organization. For instance, if a company has a centralized HR department, its costs would be allocated to all departments that benefit from HR services.

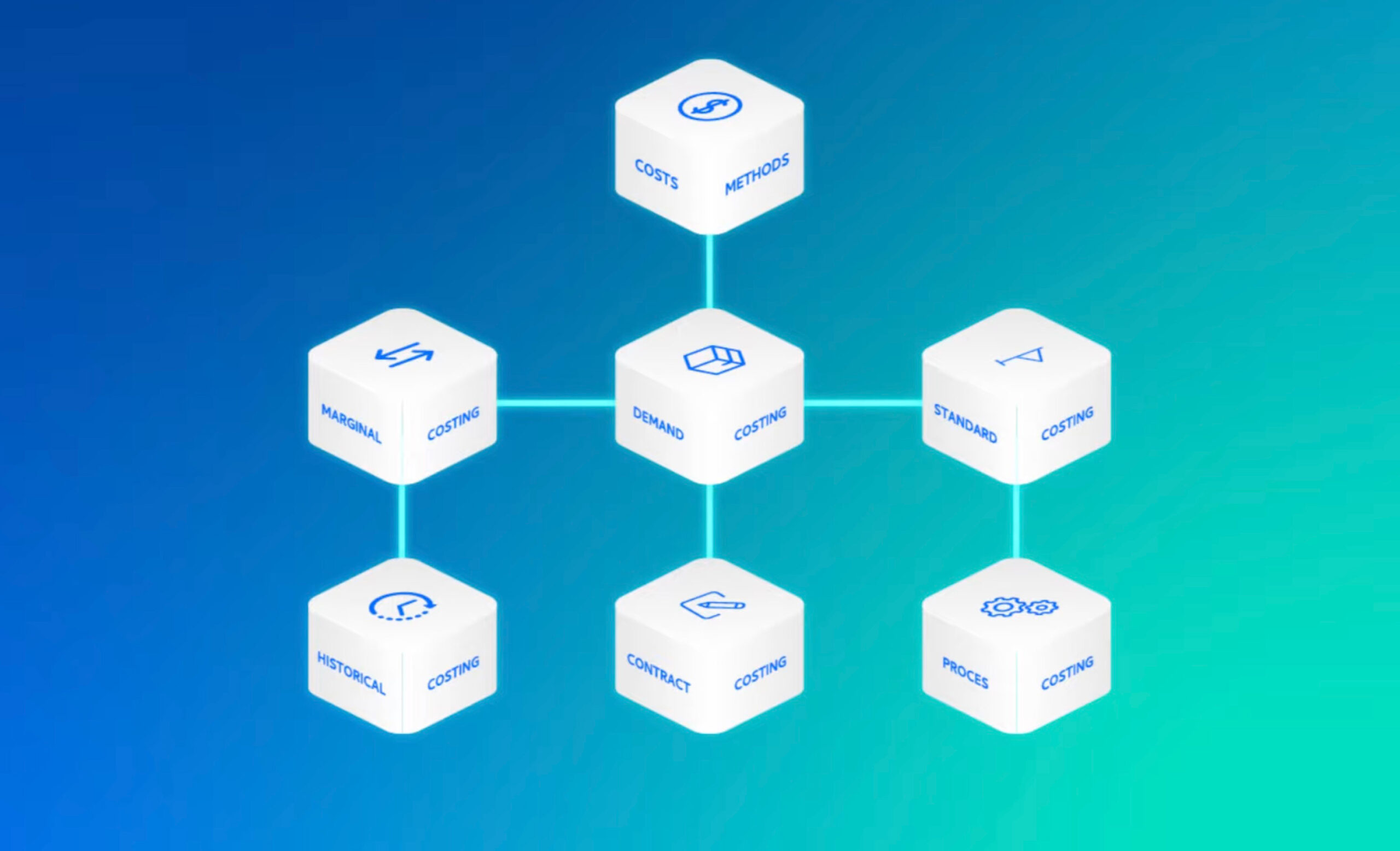

Methods of Cost Allocation

There are various methods of cost allocation, each designed to suit different organizational structures, goals, and cost types. Below we describe 4 different cost allocation methods, which address different needs within an organization.

1. Direct Cost Allocation

Direct cost allocation assigns costs directly to a specific department, product, or project without using cost drivers or intermediary steps. This method is simple and efficient when the cost can be directly traced to a single cost object.

For instance, if a department hires a consultant for a specific project, the consulting fee can be directly allocated to that department. This technique is often used for clear, identifiable expenses that don’t require complex calculations.

2. Activity-Based Costing (ABC)

Activity-Based Costing (ABC) is a method that allocates overhead and indirect costs based on activities that drive those costs. In this method, costs are traced to activities (such as machine setup or quality inspections), and then those activity costs are assigned to products or services based on consumption.

For example, if a product requires frequent quality inspections, it will be allocated a higher share of inspection costs. This method provides more accuracy than traditional cost allocation methods because it focuses on the actual drivers of costs.

3. Time Driven Activity-Based Costing (TDABC)

Time-Driven Activity-Based Costing (TDABC) simplifies the traditional Activity Based Costing approach by using time as the primary cost driver. Rather than allocating costs based on multiple cost drivers, TDABC assigns costs based on the estimated time it takes to perform specific activities.

For instance, in healthcare settings, where multiple services are provided simultaneously—such as patient consultations, lab tests, and procedures—tracking the exact consumption of resources for each activity can be complex. TDABC simplifies this by allocating costs based on the estimated time healthcare professionals and equipment are utilized for each service.

4. Rate-Based Activity-Based Costing (Rate-Based ABC)

Rate-Based ABC is a variation of Activity-Based Costing that assigns costs to products or services based on predefined rates for each activity. In this method, activities like machine operation, labor hours, or facility usage are assigned a cost rate, which is then multiplied by the actual consumption of the activity to determine the total cost.

For example, if a machine has an operating rate of $100 per hour, and a product requires five hours of machine time, the product will be allocated $500 for that activity. Rate-Based ABC improves cost accuracy by directly linking resource consumption to established rates, making it especially useful in environments with stable, repeatable processes.

Please note that the difference between Time Driven ABC and Rate Based ABC is mainly in the fixed rate within Rate Based ABC. Applying a fixed rate can lead to an over or undercoverage of the total cost of the resource the rate is applied upon. This can give great insights in efficiency or capacity utilization.

Push and pull allocations represent overarching approaches that can be applied to many cost allocation methods

1. Push Allocations

In push allocations, costs are “pushed” down from a central pool (such as a centralized IT department or the management office) to specific cost centers or products. This method is useful when distributing indirect costs such as rent, utilities, or administrative expenses.

For example, the cost of office rent may be allocated to different departments based on the square footage occupied by each. As den Hartog explains, “When we talk about push allocations, I’m trying to get my costs from my general ledger towards the goals that I want to get them to, either to a department, product, service, client or in a more granular case: transaction.

Other examples of pushed cost allocation drivers are the number of processed invoices for finance or the number of new employment contracts for the HR department. Within Push allocations usually the aim is to allocate all the cost. This is to achieve an integral cost price.

2. Pull Allocations

Push allocations are commonly used when management needs to assign overhead costs to specific units for more accurate profitability analysis.

Pull allocations work in the opposite direction, using actual or expected output or resource consumption data to allocate costs. In this method, costs are “pulled” from the resources or activities to the specific products or services based on the resources consumed or services provided.

For example, a manufacturing company may allocate labor costs based on the number of products produced by each department. If one department produces more units, it will bear a larger share of the labor costs.

Pull allocations are particularly useful when the cost structure is volume-driven, meaning that costs are influenced by the level of activity. This method is mostly used by organizations that would like to get a good grip on the differences between actual costs and expected cost based upon volumes. These allocation models are usually capacity aware.

Challenges of Cost Allocation

Cost allocation is not without its challenges. Many organizations, particularly large ones, struggle with allocating costs accurately and fairly. Some of the most common challenges include:

1. Granularity of Data

Larger organizations may find it challenging to allocate costs at a sufficiently detailed level.

For example, a company might wish to allocate costs to specific products, departments, or services, but without the necessary data granularity, the accuracy of these allocations could suffer. This often results in reliance on estimates or averages, which can distort the true cost structure and profitability of different segments.

Ensuring that the data used in cost allocation is detailed and accurate is essential for getting a clear picture of business performance. In some cases, businesses can overcome this by adopting multi-dimensional cost allocation methods, where costs are divided based on multiple factors like product type, geographical location, or customer segments. For instance, a company may find it “easy” to allocate marketing costs to a certain region or a customer type versus a specific product. Or the other way around: a campaign is aimed at a product instead of a specific customer group. By allocation cost at a higher level (a dimension) one can use the information from other systems (for example: the transactions file) to “pull” these cost from those dimensions.

2. Cause-and-Effect Relationship

A crucial principle in cost allocation is ensuring that costs are distributed based on the cause-and-effect relationship between the resource and the cost object. Sander den Hartog emphasizes that “the one that causes the cost should also bear the responsibility for it.” This principle ensures fairness and accuracy in the allocation process, preventing one department from subsidizing the costs of another.

However, determining the exact cause-and-effect relationship can be complex. For instance, certain overhead costs may not have a direct, one-to-one relationship with any single department or product. In such cases, businesses often resort to using proxies or drivers (like machine hours or employee headcount) to allocate costs in a way that best represents the cost structure.

3. Regulatory Compliance

In industries like telecommunications, healthcare, or utilities, regulatory bodies impose stringent requirements for how costs must be allocated. Failure to comply with these regulations can result in fines, penalties, or even legal challenges.

For instance, utilities may need to demonstrate that they allocate costs in a way that ensures fair pricing for consumers, while telecommunications companies may need to use specific costing methodologies for regulatory reporting.

Complying to these regulatory requirements can be a significant challenge for organizations, especially those operating in multiple jurisdictions with different rules. Transfer pricing, for instance, is an area where cost allocation must comply with international tax regulations, ensuring that costs assigned between different entities within the same corporation reflect market-based prices, adhering to the “arm’s length” principle, as highlighted by den Hartog.

4. Availability of Data

Data availability is another significant challenge in cost allocation. Organizations often find that the data needed to allocate costs accurately is either insufficient, outdated, or incomplete. As a result, they may face difficulties in determining the correct basis for allocation, which can lead to poor decision-making or compliance issues.

Sander den Hartog suggests that organizations shouldn’t wait for perfect data before starting their cost allocation process. Instead, they should begin with the data they have, refine their methods over time, and use the insights gained from initial allocations to improve data collection and cleansing processes. This iterative approach can help organizations continuously improve their cost allocation practices as they gain more insights into their cost drivers and resource usage.

Best Practices for Effective Cost Allocation

While cost allocation can be complex, following certain best practices can help organizations streamline the process, ensure fairness, and enhance profitability analysis.

1. Focus on Cause and Effect

As previously mentioned, aligning cost allocation with the cause-and-effect principle is key to achieving fairness and accuracy. Businesses should always strive to assign costs based on the actual consumption of resources. For instance, departments that generate higher levels of sales should only bear a greater portion of the costs associated with sales and marketing activities if these activities were really targeted towards that department.

When allocating overhead costs, it’s important to choose drivers that reflect the relationship between the cost and the benefit received. For example, IT costs might be allocated based on the number of users supported, while administrative costs might be allocated based on the number of employees in each department.

2. Use Multi-Dimensional Allocation

For businesses with complex operations, multi-dimensional cost allocation can provide more precision and flexibility. This method allows costs to be allocated based on several factors or dimensions, such as product type, customer segment, geographic region, or service type. By allocating costs across multiple dimensions, businesses can gain deeper insights into their cost structure and identify areas for improvement.

Multi-dimensional allocation is especially useful for large organizations with diverse operations, as it provides a more nuanced view of how costs are distributed across the organization.

3. Leverage Automation and Cost Allocation Software

Manually managing cost allocation can be time-consuming and error-prone, especially for large organizations with multiple cost centers. Automation through cost allocation software can significantly improve accuracy, efficiency, and transparency in the allocation process.

Tools like CostPerform are designed to handle complex cost allocation scenarios, automate repetitive tasks, and provide insights into cost structure and profitability. By using cost allocation software, businesses can track costs at a more granular level, generate reports, and easily comply with regulatory requirements.

Sander den Hartog advocates for using advanced cost analysis tools, “even if you don’t choose to use CostPerform, please use tooling.” The right software solution can automate many of the tasks involved in cost allocation, making the process more accurate and less labor-intensive.

4. Set Clear Objectives for Cost Allocation

Before diving into cost allocation, it’s crucial to establish clear objectives for what the organization aims to achieve. Whether the goal is improving profitability analysis, meeting regulatory compliance, or gaining a better understanding of resource consumption, setting these goals helps define the method and technique that should be used.

For example, if the primary objective is compliance with tax regulations, companies might focus on transfer pricing rules and ensure their allocation meets legal requirements. If the goal is internal profitability analysis, driver-based allocations that link cost drivers directly to product lines might be the best approach. Having well-defined objectives helps in selecting the right allocation techniques and makes the process more focused and effective.

5. Regularly Review and Adjust Allocation Methods

Cost allocation is not a one-time exercise. As organizations grow and their operations evolve, their cost structures will change as well. It’s important to regularly review and adjust cost allocation methods to ensure they remain accurate and relevant.

For example, a company might initially use square footage to allocate rent expenses among departments. However, if certain departments start using remote work arrangements, the company may need to adjust the allocation method to account for changes in space utilization. Similarly, technological advancements or shifts in market demand may affect the allocation of IT or HR resources, requiring an updated allocation approach.

Regular reviews also help identify inefficiencies in the allocation process. By comparing allocated costs to actual resource consumption, organizations can fine-tune their methods to ensure they reflect the true costs associated with each department, product, or service.

Common Examples of Cost Allocation

Understanding real-world applications of cost allocation is crucial to appreciating its importance in business decision-making. Below are a few examples of how companies typically allocate costs.

1. Allocating Overhead Costs

One of the most common uses of cost allocation is distributing overhead expenses such as rent, utilities, and administrative salaries. Overhead costs do not directly generate revenue but are necessary to run the business. These costs must be allocated across the departments that benefit from them.

For instance, a company may allocate rent costs based on the square footage occupied by each department. If the marketing department occupies 30% of the office space, it may be allocated 30% of the rent expense. Similarly, utilities may be allocated based on the number of employees or equipment used in each department.

2. Allocating IT Costs

Many companies have centralized IT departments that provide support to multiple business units. In this case, IT costs need to be allocated to the departments that use these services. One way to do this is by using a driver-based allocation method that assigns IT costs based on the number of users, devices, or software licenses in each department.

For example, if the sales department is responsible for 40% of a company’s IT support tickets & hardware usage, it should bear 40% of the IT department’s costs. This ensures that each department is accountable for the resources it consumes and prevents departments with lower IT usage from subsidizing the costs of departments with higher IT demands.

A more advanced method for allocating IT costs is through Technology Business Management (TBM) techniques, which essentially apply activity-based costing (ABC) to your IT department. Under TBM, every IT service is assigned a price and volume, enabling the use of consumption-based allocation methods. This ensures IT costs are distributed based on actual service usage, providing greater accuracy and transparency.

3. Allocating Marketing Expenses

Marketing expenses, such as advertising campaigns or promotional events, often benefit multiple product lines or business units. As a result, companies need to allocate these costs based on the revenue or sales generated by each product or unit.

For example, if a company runs a $100,000 advertising campaign that promotes three different product lines at the same time, it might allocate the marketing costs based on the sales volume of each product. If Product A generates 50% of total sales, it will be allocated 50% of the marketing expenses.

This approach ensures that the costs of marketing activities are distributed fairly across the products or departments that benefit from them, rather than being assigned to one area arbitrarily.

A more sophisticated approach would be to allocate the $100,000 based on the regions where the money was spent. By using sales figures from each region as an allocation driver, this method provides a more precise and strategic distribution of costs.

4. Allocating Human Resources Costs

In many organizations, the human resources (HR) department provides services to all employees, such as recruitment, payroll management, and training. These services benefit every department in the company, so HR costs must be allocated proportionally.

One common approach is to allocate HR costs based on headcount or full-time equivalents (FTEs). For example, if the operations department has 100 employees out of a total of 500 employees in the company, it might be allocated 20% of HR costs. This method ensures that HR costs are distributed fairly based on the number of employees in each department.

The Role of Cost Allocation in Regulatory Compliance

Cost allocation is not only important for internal decision-making but also for ensuring compliance with external regulations. In many industries, financial regulators require companies to demonstrate how they allocate costs, especially when those costs affect pricing, tax reporting, or financial disclosures.

1. Transfer Pricing and Tax Compliance

Transfer pricing is a key area of cost allocation for multinational corporations. When different entities within the same corporation exchange goods or services, they must assign prices that comply with the “arm’s length” principle. This principle ensures that the price charged between related entities is the same as what would be charged between independent parties.

Transfer pricing rules are especially important for tax compliance, as companies operating in multiple countries may be required to report how they allocate costs and profits across different jurisdictions. Sander den Hartog explains that transfer pricing is “a form of cost allocation” that must be handled carefully to ensure regulatory compliance. Incorrect allocation of costs in this context can result in hefty penalties or tax audits.

2. Regulatory Reporting in Utilities and Telecommunications

In regulated industries such as utilities and telecommunications, companies are often required to allocate costs in specific ways to ensure fair pricing for consumers. For example, utility companies may need to allocate the costs of maintaining infrastructure (such as power lines or water pipes) to the different customer groups that use these services.

Telecommunications companies face similar requirements when allocating the costs of building and maintaining network infrastructure. Regulatory bodies may require companies to demonstrate that their pricing models fairly reflect the costs associated with providing services to different customer segments.

3. Government and Public Sector Agencies

For government agencies, particularly in the United States, prices for services should be set at a level which is in line with costs. Accurate cost allocation and understanding of cost drivers is critical for this process.

For example, a government agency like the United States Patent and Trademarks Office must ensure it meets its federal mandate to put a price on an application for a new patent, which is inline with the costs it encounters. For a complex operation like this, agencies must employ cost allocation software.

Why Effective Cost Allocation Matters

Cost allocation is a critical component of accounting and financial management that ensures transparency, accuracy, and fairness in the distribution of costs across an organization. By defining and implementing effective cost allocation methods, businesses can gain a clearer understanding of their cost structure, make more informed decisions, and improve overall profitability or efficiency

Whether through push allocations, pull allocations, or driver-based methods, companies must tailor their cost allocation approach to their specific needs and goals. As Sander den Hartog emphasizes, aligning cost allocation with the principle of cause and effect is essential for ensuring that the entities responsible for generating costs bear the appropriate share of expenses.

By ensuring the right cost allocation process is in place, and supporting that process with the right tools, organizations can optimize their cost allocation practices and unlock valuable insights into their operations. And with these pieces in place, businesses can improve financial performance and meet the growing demands of a competitive marketplace.

To learn more, continue reading our blog series, with methods of cost allocation explained. For a practical case study. Download CostPerform’s Corporate Allocations Whitepaper for an in-depth look at cost allocation in business. Or request a demo from the team at CostPerform if you are curious to learn more about the software.