Use a cost control system to help you have the right conversations

Traditionally, the financial administration was the main focus for the departments full of number crunchers. But with the increase of technology, financial administration has become less time-consuming, leaving room for an increased focus on business performance. Large white-collar affairs have however heavily increased the focus on control and a manual cost control system. But once again, technology stepped in which resulted in the rise of the cost control system. As a result: the finance function is once again in pole position to act as the partner of the business.

A cost control system is about controllable cost

More than often, the finance function and business bicker over the height of the cost in relation to the budget. Some of those discussions are even held with the wrong departments. Who is accountable? We argue that any company or government agency should try to put the budget at the department that can control it. In other words: implement a working cost control system, tailored to your business Let’s take the IT department as an example: the total costs for electronic devices should be the responsibility of the departments using them. They determine the volume and the specs needed, not the IT department. A tight cost control system helps you decipher these costs and who’s responsible for them.

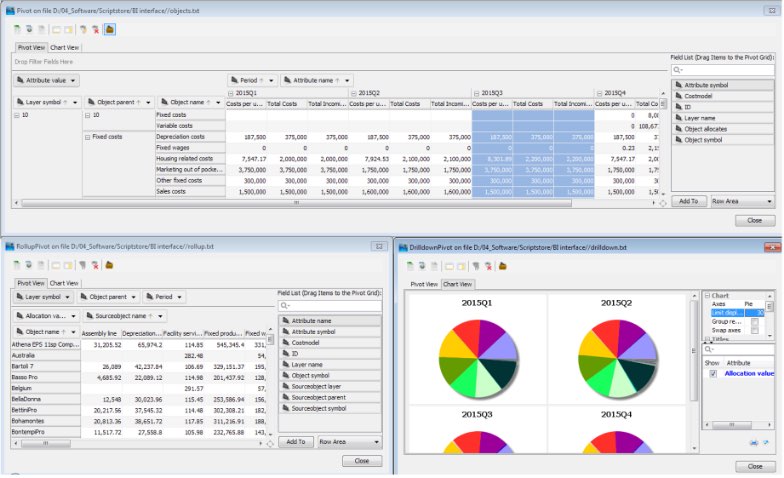

The IT infrastructure, however, is not the responsibility of the business and budget for that should therefore remain at IT. This could lead to a situation where you have a bill of IT (also see our TBM page) and an invoice stream between IT and other departments. CostPerform can help you automate these mechanisms and create an optimal cost control system.

A tight cost control system helps you to have the right conversations.

An optimal cost control system is about having the right conversations

Imagine a conversation between the CEO and the COO:

“You are over budget with your costs!”

“But I have produced 10% extra, so the extra 8% cost is actually quite good.”

“mmm, so you’re telling me that 80% of your cost is variable? I thought it was 50%.”

“No, but I had to deal with Covid, so my efficiency was down 3%.”

“mmm, and what happened with the 10% decrease in material and energy prices in 2020?”

“Sorry, but I don’t have that information.”

A discussion about why costs are at the level they are, and where no real conclusions are drawn leads both the COO and the CEO dissatisfied into the new budget rounds. Using a tight cost control system helps you have the right conversations. Both the COO and the CFO should try to find the effects of volume changes, price changes, efficiency changes, fixed/variable ratio. CostPerform can help you solve this puzzle for every period. Whether it be yearly, quarterly or monthly. Which system is the optimal cost control system for your company, can be solved according to the scheme below.

Summary

In short, a cost control system gets everyone on the same page. It deciphers costs and allocates them to the department who is responsible. This gives you clarity when looking at the performances of different departments and when a new budgeting cycle begins. A good working cost control system makes sure that you have a good foundation for conversation.