Regulatory Reporting and Reciprocal Allocations

How National Bank of Belgium uses CostPerform for reporting to the European Central Bank and improved cost calculations.

Challenge

The NBB had very strict reporting requirements to the ECB which needed to be met, as well as reciprocal allocations in their cost model.

Solution

Using a well-documented cost model and methodology, NBB performed a lift and shift from Oracle HPCM to CostPerform.

Benefits

A replicated and improved cost model performed 10x faster in CostPerform. Roll-up reporting made cost transparency easy.

About National Bank of Belgium

The National Bank of Belgium (NBB) stands as a pivotal institution in Belgium’s financial landscape, committed to maintaining financial stability and fostering economic prosperity.

As the central bank of the country, the NBB plays a crucial role in formulating and implementing monetary policies, overseeing the financial system, and ensuring the smooth operation of payment and settlement systems.

With a history steeped in tradition and a forward-looking approach, the NBB is dedicated to serving the economic interests of the nation, ensuring the integrity of the financial sector, and contributing to the sustainable growth of the Belgian economy.

Regulatory Reporting & Reciprocal Allocations

The National Bank of Belgium (NBB) faced a multifaceted challenge centered around its reporting to the European Central Bank (ECB) in Frankfurt.

The NBB was also tasked with the intricate process of incorporating reciprocal allocations into their cost calculations.

Reporting Accuracy and Timeliness

The NBB was under stringent requirements to deliver reports of the highest accuracy to the ECB. The reports needed to reflect the bank's financial health and operations with exactitude, leaving no margin for error. Moreover, these reports were time-sensitive, with strict deadlines imposed, making it imperative for the NBB to have a system that could ensure prompt delivery without compromising on the quality of the information provided.

Complex Cost Calculations

The bank's cost calculations were far from straightforward. The need to include reciprocal allocations added layers of complexity to the process. Reciprocal allocations are intricate as they involve the allocation of costs between different departments or products, considering the mutual services exchanged. This process required a nuanced understanding and sophisticated methods to manage effectively, ensuring that the cost allocations were both accurate and reflective of the internal services rendered.

Performance Efficiency

With the existing system in place, the bank faced challenges in terms of performance efficiency. The process of generating reports and performing cost calculations was not only complex but also time-consuming. This inefficiency could lead to delays and potential inaccuracies, posing a significant risk given the critical nature of the reports and the importance of the cost calculations for internal and external stakeholders.

In-depth Methodology Analysis

The cornerstone of the solution was a thorough analysis of the bank's existing cost model, which was initially structured in Oracle HPCM. This step involved a detailed examination of the current methodologies and processes to identify the bottlenecks and inefficiencies. By accessing and scrutinizing extensive documentation, the team gained a comprehensive understanding of the intricate cost calculation process, including the complex reciprocal allocations, paving the way for the development of a more refined and efficient model.

Reconstruction and Enhancement of the Cost Model

Armed with a deep understanding of the inherent complexities and the identified areas for improvement, the team embarked on reconstructing the cost model. This wasn't just about replicating the existing system; it was about enhancing it. The reconstruction involved re-engineering the process flows, optimizing the allocation logic, and integrating advanced computational strategies to handle the reciprocal allocations more effectively. The result was a robust, agile, and more efficient cost model that significantly reduced the time and resources required for the computations.

Performance Optimization

The final pillar of the solution focused on optimizing the performance of the cost model. The newly developed system was not only designed to be more accurate but also significantly faster. By leveraging advanced technologies and optimization techniques, the solution achieved a tenfold increase in performance efficiency. This drastic improvement meant that the bank could now process complex cost calculations and generate detailed reports in a fraction of the time previously required, thereby enhancing the overall productivity and reducing the turnaround time for critical financial reporting.

National Bank of Belgium & CostPerform

In response to the multifaceted challenges faced by the National Bank of Belgium, a comprehensive solution was meticulously designed and implemented, while still using the off the shelf software of CostPerform.

The approach was not just about addressing the immediate issues but also about enhancing the overall efficiency and accuracy of the bank’s reporting and cost calculation processes.

The solution involved a deep dive into the existing methodology, leveraging extensive documentation, and reconstructing the cost model to not only match but exceed the performance of the previous system.

Regulatory Reporting In Time, Based On Proper Allocations

Remarkable Increase in Performance Efficiency

The solution delivered a 10x increase in processing speed for cost calculations and financial reporting, enabling the National Bank of Belgium to meet critical deadlines efficiently and maintain the accuracy and integrity of its financial data.

Enhanced Cost Transparency and Accessibility

The new reporting framework provided detailed insights into cost structures, fostering informed decision-making by making financial data more accessible and understandable for internal stakeholders.

Long-term Reliability and Partnership

The sustained use of the enhanced cost model for over 7 years demonstrates its reliability and the value it brings to the bank, highlighting a successful long-term partnership and the adaptability of the solution to evolving business needs.

About CostPerform

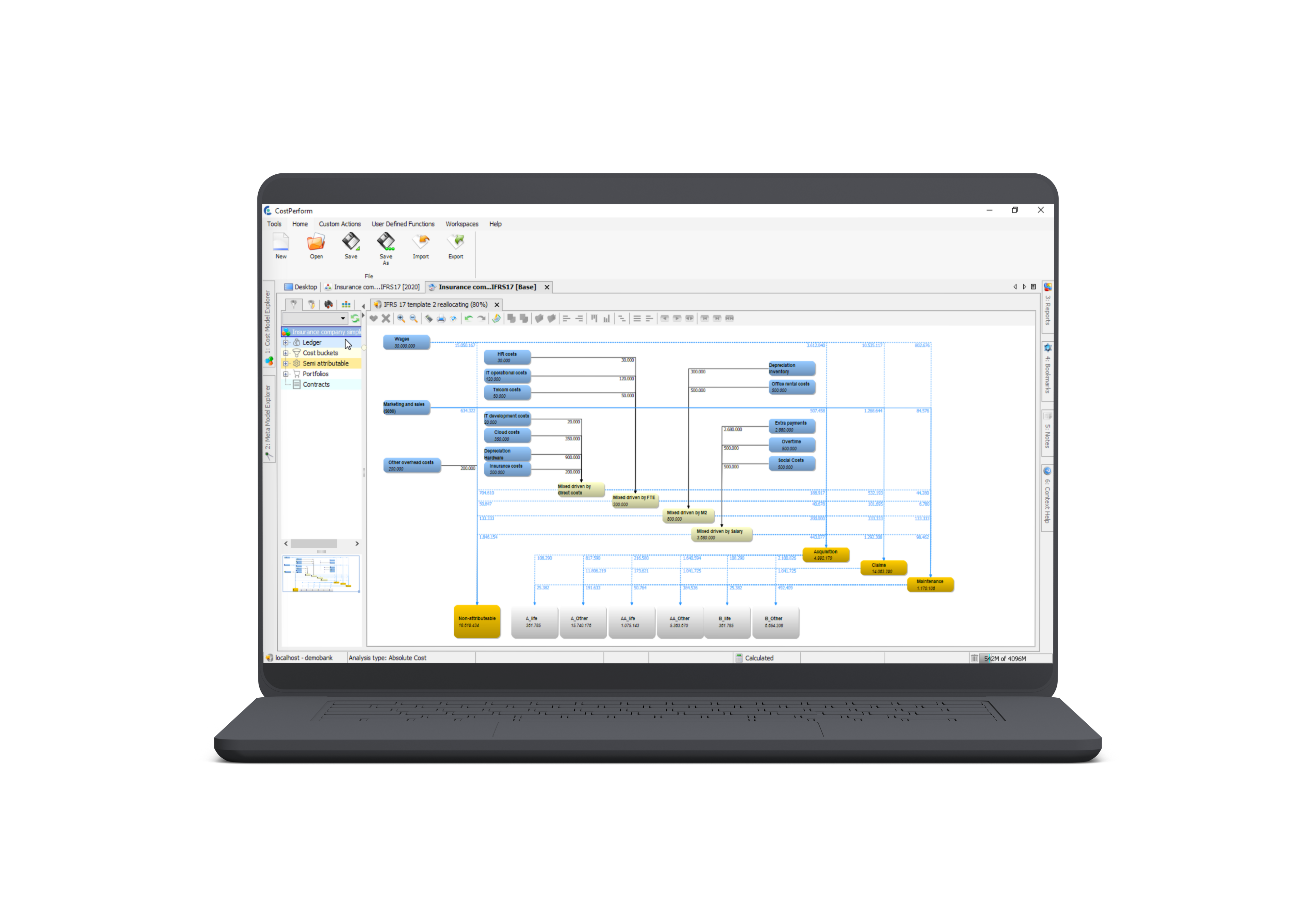

Crafted over 20+ years by econometrists and cost experts, CostPerform is the solution for defining, designing, and maintaining your cost and profitability model. Any mathematical approach of cost allocation you can think of, is possible.

From insurance companies and merchant banks to central banks: CostPerform is used by financial institutions to determine profitability, report to regulators and to simulate future business models.

Contact us today to get insights into which products, customers, channels or transactions make you the most money, after calculating the associated costs.